What Australian/International allocations should you choose?

A decision everyone needs to make when choosing a DIY portfolio, either in super or outside of super, is how much one should allocate to the Australian market vs the International market. There are number of factors and potential biases one should consider before deciding on the degree of home bias. One of these factors includes considering the optimal allocations. Mukherjee (2016) considers three types of models in estimating the optimal allocations:

- Capital Asset Pricing Model (CAPM): assuming market-cap weightings to be the optimal allocations, market-cap weightings are the proportion of a country’s market size in relation to the world’s market size. For Australia, this is roughly 2%. However, the restrictive assumptions of the CAPM, such as information symmetry and disregarding transaction costs, make this unrealistic in practice.

- Mean-variance optimisation: using historical data to calculate optimal weightings. This approach makes it hard to get a reliable estimate as results can vary wildly with different start and end dates.

- Mixed modelling: addresses the limitations of CAPM and mean-variance, where an increasing mistrust of CAPM results in weightings closer to mean-variance but with more reliability.

In this article, I’ll be using the efficient frontier model to calculate the mean-variance optimal allocations. Note that the model has limitations that may not accurately represent the real world. For the model, I took the data from Vanguard Chart and manually entered it into this spreadsheet, which contains monthly returns from 1970 to 2023.

Disclaimer: I cannot guarantee I did the calculations correctly, so please be aware of that.

From the data, I found that a 33% Australian allocation gave the lowest volatility, and a 31% Australian allocation gave the highest Sharpe ratio (the ratio between returns and volatility). The data does not include franking credits; however, including them would not affect the outcome of the Efficient Frontier model as it doesn’t affect the volatility of the Australian market.

However, it should be noted that the optimal Australian allocation for minimum volatility varies throughout history, as shown in the chart below:

The optimal allocation changes throughout time because the Australian market and International market take turns outperforming each other. This is illustrated in the chart below:

As I mentioned at the start, there are number of factors and potential biases to consider when deciding on Australian/International allocations. Other factors to consider when deciding how much to allocate towards Australia include:

- Concentration risk: the Australian market has high sector concentration in Financials and Materials. The top 10 Australian companies also make up roughly 45% of the ASX/S&P 300 as at 31 August 2023.

- Cost: A200/IOZ/VAS is cheaper than VGS/BGBL.

- Tax advantages (franking credits) and disadvantages (high distribution yield).

- Including additional asset classes, such as emerging markets, such that it reduces the need to use Australia as a diversifier.

Some behavioural biases to be aware of, listed by Ardalan (2018), include:

- Familiarity: feeling comfortable with investing in companies they know and see.

- Regret: investors who use their home market as the benchmark could suffer from regret if they see the international market doing poorly.

- Overconfidence: the perception of having an information advantage relative to foreign investors.

- Competency: investors that believe they are more competent with home equities than international equities.

- Optimsim and patriotism: the belief that home equities will perform better than international equities or as a way to support their country’s economy.

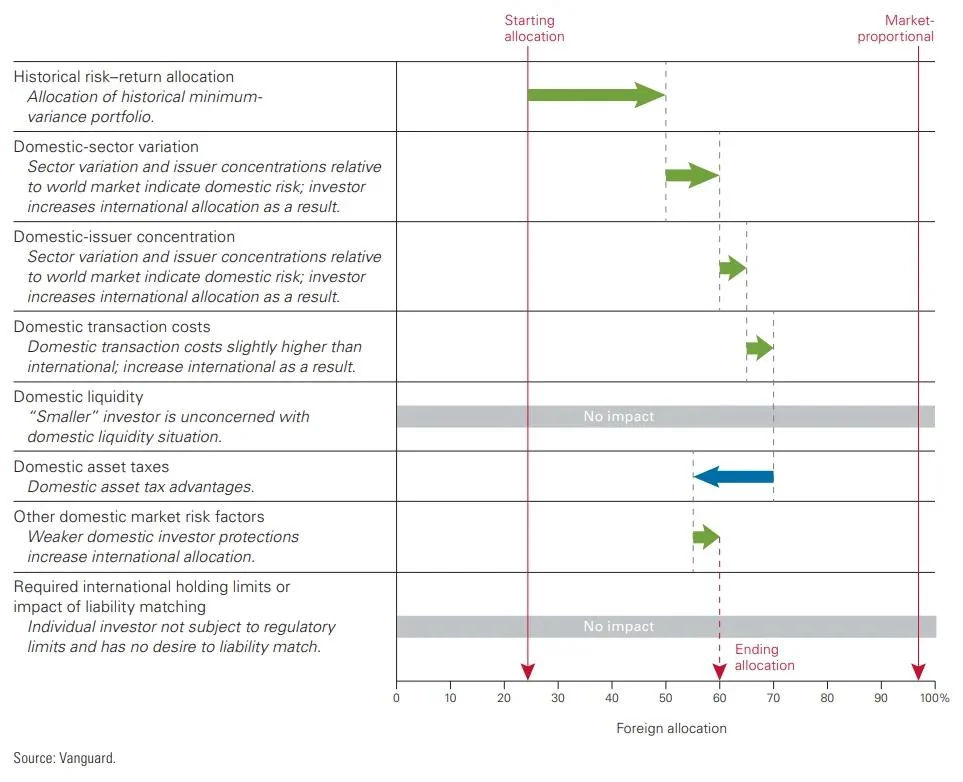

The Vanguard paper, The Role of Home Bias in Global Asset Allocation Decisions, considers the thought process of a hypothetical investor deciding on 40% Australia.