Most popular brokers to buy ETFs

Investing for beginners: Part 6 of 8

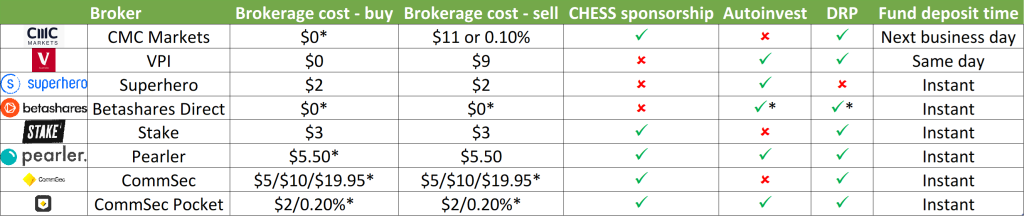

In the previous article: Choosing index funds for Australians, I go over what ETFs one can use to get started. After deciding on what ETFs to invest in, you need to sign up with a broker to facilitate the buying and selling of ETFs. This article summarises the most popular brokers to do this, assuming the ETFs are listed on the Australian Stock eXchange (ASX). The brokers mentioned may not be geared towards other financial instruments or securities.

Summary

CHESS sponsorship vs custodian model

Read this article by PassiveInvestingAustralia to understand what CHESS sponsorship and share registries are. To expand on the pros and cons of a CHESS sponsored broker vs a custodian-based broker listed in that article:

- Share registries: when buying ETFs through a CHESS sponsored broker, you need to make an account with a share registry. Share registries may be annoying to deal with. Examples include withholding your dividends if you forgot to provide your TFN, making sure your names and details match exactly, especially with multiple HINs, and potentially needing to make an account with multiple share registries. Below is a list of share registries fund managers use:

- Vanguard: Computershare

- Blackrock: Computershare

- Betashares: Link Market Services

- VanEck: Link Market Services

- SPDR: Link Market Services

- Tax reporting: If using a CHESS sponsored broker, tax details relating to distributions of ETFs get prefilled in MyTax. If selling an ETF, it is easiest to use a service like Navexa or Sharesight to record all trades to report tax accurately. For custodian brokers, tax details may or may not prefill in MyTax, but the broker sends a tax statement and an accompanying guide to you to fill in the details yourself. Therefore, using a service like Navexa or Sharesight to do tax reporting may not be necessary for some custodian brokers; however, the broker will typically use first-in-first-out (FIFO) to calculate capital gains/losses when you sell. This means that you won’t have the option to choose another method like last-in-first-out (LIFO) to minimise tax for a financial year.

- Initial investment: For most CHESS sponsored brokers, ASX-listed products must have an initial investment of $500. This is known as the minimum marketable parcel. Any following trade for that product can be any amount. This doesn’t apply to brokers that use the custodian model, where they generally have their own reoccuring minimum investment amount.

- Transfers: Transferring a portfolio between CHESS sponsored brokers is always free and can be done by filling out the form provided by the broker you’re moving to. Custodian brokers can be more restrictive, which could make it more difficult to transfer into or out of a custodian broker.

What is a Distribution Reinvestment Plan (DRP)?

Note: Distributions = dividends + capital gains incurred by the fund manager + other income

Instead of having the distributions be paid into your broker account, you can turn on DRP to automatically reinvest the distributions (you still pay tax on these distributions). However, if the distributions do not amount to one whole share (also known as cash residual), then they sit around earning no interest until there are enough distributions to equal a share.

To enable DRP, if the broker is CHESS sponsored, then you need to go into your share registry account to turn it on. Most custodian brokers don’t have a DRP option as your ETFs won’t be connected to a personal share registry account, but some may offer a substitute version.

If you decide to sell an ETF that has DRP enabled, you may not receive the cash residual, depending on the ETF provider. The table below shows what fund managers do with the cash residual:

| Fund manager | Cash residual | Reference |

|---|---|---|

| Vanguard | Does not keep | Section 9.4 |

| Blackrock | Does not keep | Section 9.4 |

| Betashares | Does not keep if residual is greater than $1 | Section 5 (g) |

| VanEck | Keeps | Page 1 |

| SPDR | Does not keep | Section 4.6 |

Brokers

CMC Markets

- $0 brokerage up to $1,000 per stock per trading day. This means that you can split your money into multiple ETFs that are less than $1,000 each or make a less than $1,000 trade into an ETF over several days to get $0 brokerage.

Vanguard Personal Investor (VPI)

Last updated: 08/11/2025

- $0 brokerage on buys and $9 brokerage on sells.

- $200 minimum initial trade amount, minimum 1 unit for additional investments. $200 minimum for autoinvesting.

- Receive an annual tax statement. May or may not prefill.

- You can only buy Vanguard products (excluding VTS/VEU).

- Can’t transfer holdings into VPI, but can transfer holdings out.

- The mobile app is not as user-friendly as other brokers.

Superhero

- $2 brokerage for ETFs or 0.01% for trades over $20,000.

- $10 minimum trade amount.

- $5 per ETF to transfer to another broker (I’ve read online that this only applies to ETFs held for < 12 months, but they may have recently changed it as I don’t see that mentioned in their Fee Schedule).

Betashares Direct

Last updated: 04/10/2025

- $0 brokerage for buying and selling.

- Supports fractional investing, allowing you to invest the exact amount you want.

- $10 minimum for buy orders and no minimums for sell orders.

- Receive an annual tax statement. Information gets prefilled except for CGT related to selling holdings.

- There are no portfolio fees if:

- You invest in ETFs without creating a Managed Portfolio, or

- Autoinvest in up to five Betashares ETFs (excluding short funds or other funds as determined by Betashares. Minimum $100 for each order).

- If you do create a Managed Portfolio, you can either choose (more details can be found here):

- Core and Focused Portfolios: diversified portfolios that are constructed and managed by Betashares.

- Custom Portfolios: build your own portfolio of shares and ETFs using up to 50 holdings.

- There is no minimum cash balance, deposit, or withdrawal amount.

- Transfers in are free while transfers out cost $9.50 per security.

Stake

- $3 for trades up to $30,000 and 0.01% of trades about $30,000

- When transferring your holdings into Stake from another broker, Stake creates a new HIN for you, so you would need to redo your account details and DRP. This also means any cash residual will either be paid out or lost, depending on the ETF provider.

- Transfer your ASX portfolio (over $1,000) to Stake, and you’ll get $3 off your brokerage fees for a year.

Pearler

- Normal brokerage is $6.50, but can be lowered to $5.50 by prepaying $55.

- Promotes long-term investing. Pearler tries to do this in a number of ways:

- Fosters a community to help motivate users to achieve their financial goals. They do this by having a community tab with shareable profiles to show how other people are investing and their progress in achieving their goals.

- Resources to help users learn about personal finance. This includes articles created by community members, podcasts, and investing calculators.

- Rewards to incentivise long-term investing.

- Open and transparent with how they plan to improve the platform, engaging with the community to help them improve.

- Currently, the website and mobile app can be clunky to use at times.

Commsec

- Brokerage fees:

- $5.00 (Up to and including $1,000)

- $10.00 (Over $1,000 up to $3,000 (inclusive))

- $19.95 (Over $3,000 up to $10,000 (inclusive))

- $29.95 (Over $10,000 up to $25,000 (inclusive))

- 0.12% (Over $25,000)

- T+2 settlement: When you buy a share or other security, there needs to be enough money in the settlement account two business days after the purchase. You risk getting a fine or warning if there aren’t any funds by the end of the second business day. When selling, the money will be deposited into the account after two business days. Go here for more information on settlements.

Commsec Pocket

- Minimum $50 initial trade amount.

- Brokerage fees:

- $2.00 for trades up to and including $1,000

- 0.20% of the value of trades above $1,000

- Only offers 10 ETFs:

- CRED: Aussie Corporate Bonds

- DHHF: Diversified Equities

- ETHI: Sustainability Leaders

- GRNV: Aussie Sustainability

- IEM: Emerging Markets

- IOO: Global 100

- IOZ: Aussie Top 200

- IXJ: Health Wise

- NDQ: Tech Savvy

- SYI: Aussie Dividends

Buying tips

- You can invest at the optimal frequency using this calculator.

- Don’t make a trade within the first or last 15 minutes of the trading day (10am to 4pm) as the “market” is waking up or about to fall asleep.

- When making a trade, the trade can either be a market order or a limit order. A market order takes the lowest (highest) available price when you are making a buy (sell) order. A limit order allows you to choose a price and ensures the price doesn’t go above (below) the price you set when you make a buy (sell) order. It is generally fine to use a market order for ETFs with high liquidity, whereas limit orders are more advantageous for ETFs with low liquidity but can also be handy if you want more control. Note that for VPI, they only allow you to use 95% of your available cash when making a market order in case of price fluctuations, so you can do a limit order instead to use 100% of your cash.

- Read this article on how to rebalance your portfolio.

Before you buy ETFs, make sure to read the next article for some tips to avoid common mistakes and clear up any misconceptions: Investing tips and fundamentals to be aware of