Choosing investment options in super

Investment options explained

All super funds will generally offer you two types of investments: Diversified/premixed investments and DIY investments.

Premixed investments will invest in a variety of assets chosen and managed by the fund managers, and so the option suits people who aren’t very knowledgeable about investments. Super funds will generally have the following premixed investment options, sorted from least risky to most risky:

- Conservative – typically 30% – 50% growth assets and 50% – 70% defensive assets.

- Balanced – typically 50% – 75% growth assets and 25% – 50% defensive assets.

- Growth – typically 75% – 100% growth assets and 0% – 25% defensive assets.

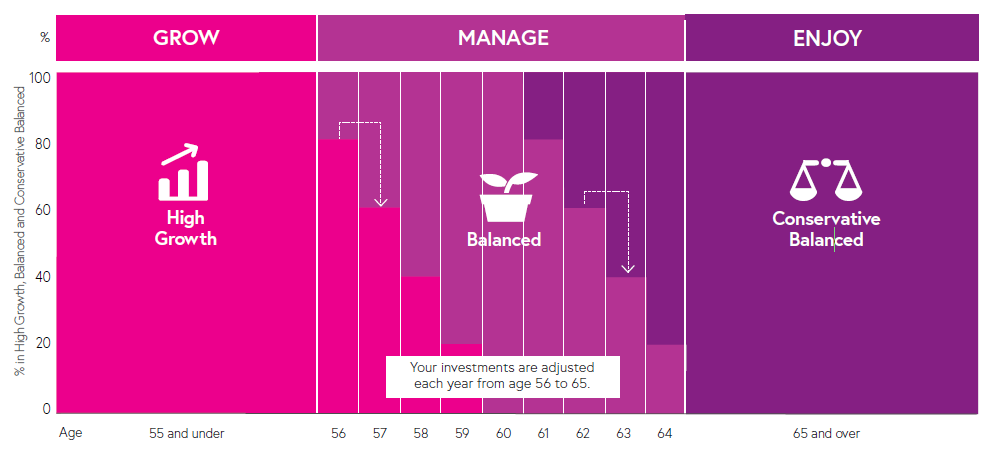

Super funds may also offer a Lifecycle investment option, which uses premixed investments and automatically switches you to lower-risk options as you approach retirement. An example of what a Lifecycle option looks like is shown below (Aware’s lifecycle option):

Super funds can also offer a Socially Responsible Investment option that invests your money more ethically. This option can vary from super fund to super fund, from different screenings to different risk levels ranging from Balanced to High Growth.

DIY investments are for people who want more flexibility with how their investments are allocated. Some common DIY options include:

- Equities – Australian shares and International shares

- Diversified interest – Australian and International bonds and other debt

- Cash – short-term money market securities and some short-term bonds

Which investment option?

If you didn’t choose an investment option when you created an account, the super fund will put you into their default investment option called MySuper, which is generally a Lifecycle option or a Balanced option. Moneysmart considers two factors when deciding on an investment option:

- How comfortable you are with investment risk – A higher growth option will have higher risk over the short term, but it will usually achieve higher returns over the long term. A conservative option will offer lower risk but lower returns over the long term.

- How long until you can access the funds – Some people choose to be more conservative with their investments as they approach retirement to reduce the risk of their balance going down. Others choose to keep their investments in growth options, seeking higher returns. There is no one correct approach.

There are 3 main options people can choose from: Lifecycle, Premixed, and DIY.

Aware Super lists the following reasons that may attract people to using their Lifecycle option:

- Don’t want to make an investment choice and would prefer to leave the hard work to our investment professionals

- Comfortable for your super to be automatically adjusted in the lead up to retirement

- Unsure about how to invest

- Unfamiliar with investment markets

- Don’t have time to check markets and make your own investment choices.

Further information on Lifecycle options:

What are lifecycle super funds, and how do they perform? (superguide.com.au)

What are Life Stage Investment Options in Super? | Canstar

For those who prefer to have more control over their investments and exposure to risk, they may wish to use premixed or DIY options instead. When deciding between premixed and DIY, there are a number of factors to consider: risk tolerance, fees, and management style.

Risk tolerance

In finance, risk tolerance refers to an investor’s willingness and ability to take on risk in pursuit of higher returns. It reflects an individual’s comfort level with price volatility and drawdowns (drops in value) and can vary from person to person as well as change over time. Factors that can influence an individual’s risk tolerance include:

- Age

- Income

- Investment goals

- Time horizon

- Personal circumstances.

It is important to be aware that determining one’s risk tolerance is highly personal, subjective, and hard to quantify, as it is hard to know how someone truly reacts in response to high price volatility and drawdowns. So, it is important to have realistic expectations for the market and one’s behaviour, as a successful investing strategy requires the person to stick to it and not deviat from it due to irrational human behaviour.

Apart from risk tolerance, it is also important to know one’s ability, willingness, and need to take risks, as mentioned in this article by Larry Swedroe:

- Ability – take someone who is 20 years old and has a time horizon of 40 years. They have the ability to go 100% equities because they have a long enough time horizon to sustain multiple crashes and achieve their financial objective.

- Willingness – However, this same person may have a low emotional tolerance to risk that prevents them from using 100% equities. So, even though they have the ability to take on high risks, they do not have the willingness to do so.

- Need – In another example, someone who is close to retirement could have a high psychological tolerance for risk, yet they already have enough in their portfolio to achieve their financial objective, so they no longer have a need to take risk.

By considering the combination of one’s ability, willingness, and need to take risks, one can decide what investment option they should take.

Articles on risk tolerance:

Asset allocation and your risk tolerance — Passive Investing Australia

Portfolio Risk Explained – How To Think About Risk and Volatility (optimizedportfolio.com)

Fees

DIY options tend to be cheaper than premixed options. However, this tends to come at the cost of reduced diversification as premixed options hold a variety of assets not accessible in DIY options. Some of these assets include private equity, unlisted assets, and infrastructure, with the aim of improving the risk-adjusted returns of the portfolio, which can be thought of as reducing risk more than it reduces return.

As Estrada (2009, p. 20-21) points out, optimising for risk-adjusted returns could suit those who are relatively more risk-averse investors, those with a short investment horizon, and those who are uncertain about the length of their holding period. On the other hand, optimising to get the highest return could suit those who are relatively less risk-averse investors, those with a long investment horizon, and those that are likely to stick to their expected (long) holding period. So, factors like risk tolerance, investment horizon, and certainty of their holding period could determine whether premixed or DIY would suit them better.

For more information on how much fees can affect your super, read this article: The impact fees have on your super

Management styles

There are two main management styles an investment option can have: active management and passive management.

Active management involves actively buying and selling assets in an attempt to beat a market benchmark, whereas passive management matches the performance of a market benchmark. You can tell whether an investment option is active or passive in the investment description or objective, where it’ll say if it tries to beat or match the market. Passively managed options may also have the word ‘indexed’ in the name. Because active management employs fund managers and researchers to try to beat the market, it incurs significantly higher fees than passive management. Thus, we ask the age-old question in investing: can active management beat passive management after fees?

Basu, Anup & Andrews, Stephanie (2014) found that from 2004 to 2012, higher expenses in superannuation funds generally led to lower returns, supporting the idea of using low-cost passive management rather than expensive active management. Drew and Stanford (2002) argue that the rational choice for Australians is a low-cost passively managed fund, where such a choice would significantly reduce the costs of superannuation and improve the returns. Sy (2008) showed mathematically that a passive portfolio following a defined market is the optimal investment strategy for all investors collectively. They also showed this to be optimal for the majority of individuals. Sy (2008) further speculates that active managers would rather chase short-term opportunities than post superior long-term performance because uninformed individuals are swayed more by short-term outperformance. This is despite the fact that short-term outperformance could be a result of luck and not the skill of a good investment manager.

To further illustrate the long-term underperformance of active management, the SPIVA Scorecard shows that 84% of active funds underperformed the Australian market over 15 years (data as of 31 Dec 2022).

Conclusion

After considering the aforementioned factors, to help make an informed decision, I have constructed the following spreadsheet comparing some of the most popular super funds based on the following investment options: Australian shares, International shares, and High growth.

Spreadsheet link: https://docs.google.com/spreadsheets/d/1sR0CyX8GswPiktOrfqRloNMY-fBlzFUL/edit?usp=sharing&ouid=110868098764009992952&rtpof=true&sd=true

Note that the options included in the spreadsheet are ideal for people with a high risk tolerance or a need to take high risks, and can be made less risky by choosing a more defensive premixed option or including defensive assets like bonds or cash.

If one is interested in indexed options, refer to this article: Comparing indexed options between industry super funds

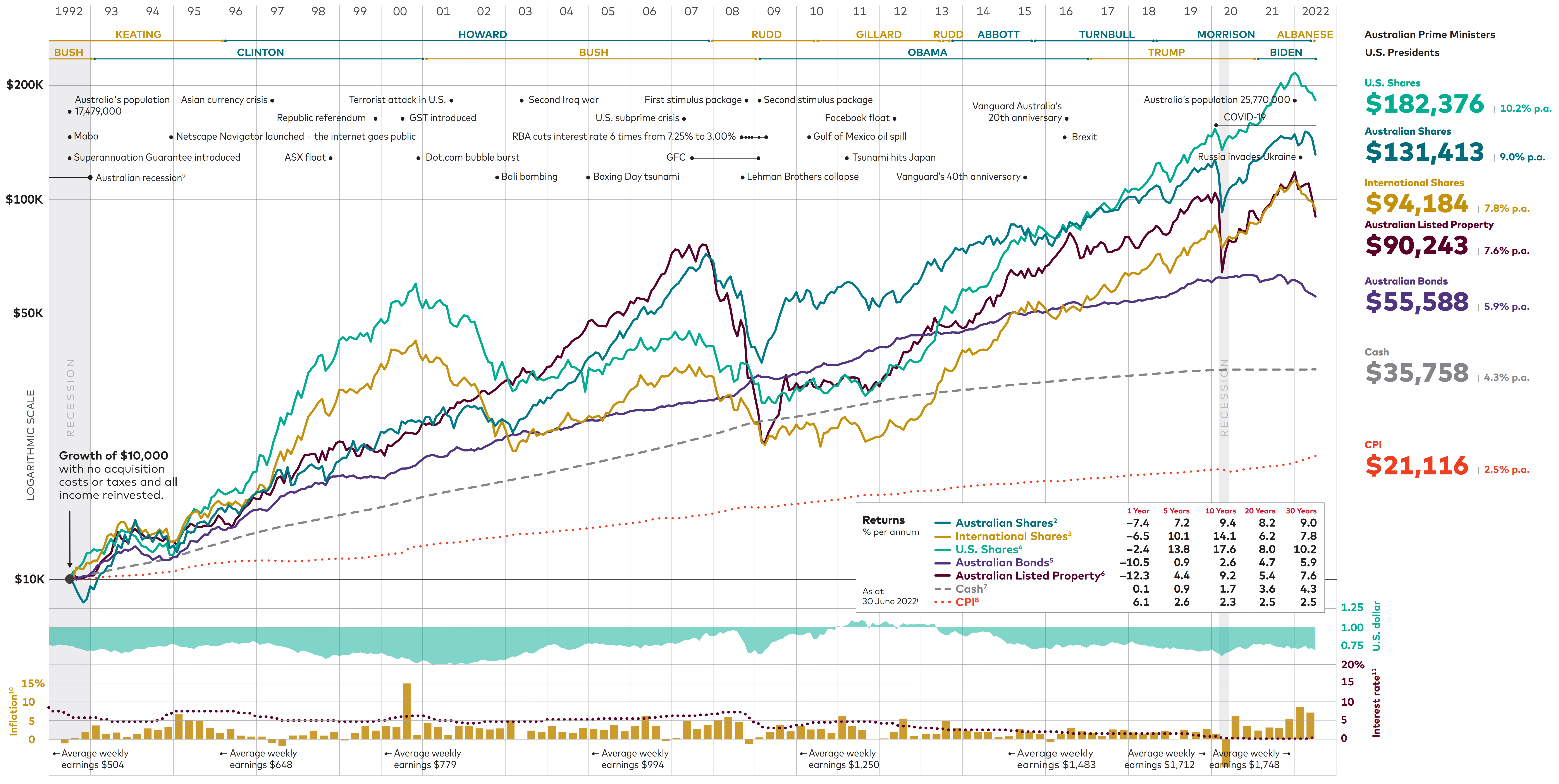

The last thing I want to mention to those who have little experience with investing is that superannuation is a long term investment. It is important to look at the bigger picture and not fret so much about bad short-term performance. That’s why I chose to include the following chart by Vanguard showing performance over 30 years (past performance does not indicate future performance):

The following table shows the average performance per year ending 30 June 2023 taken from Vanguard. Despite times when the market fell over 25%, even 45% during the Great Financial Crisis in 2007, the market always recovers.

| 1 year | 5 years | 10 years | 20 years | 30 years | 40 years | 50 years | |

| Australian shares | 14.8% | 7.3% | 8.8% | 9.0% | 9.2% | 10.8% | 10.8% |

| International shares | 22.6% | 11.5% | 13.2% | 8.4% | 7.5% | 10.0% | 10.5% |

| US shares | 23.5% | 14.7% | 16.5% | 10.1% | 10.0% | 11.9% | 12.6% |

| Australian property | 8.1% | 3.5% | 7.7% | 5.2% | 7.3% | 9.3% | |

| Australian bonds | 1.2% | 0.5% | 2.4% | 4.2% | 5.5% | 8.2% | 7.6% |

| International bonds (hedged) | -1.5% | 0.1% | 2.5% | 4.9% | 6.2% | ||

| Cash | 2.9% | 1.2% | 1.7% | 3.5% | 4.2% | 6.5% | 7.5% |