The impact fees have on your super

You may often hear that it is best to go for low fees when choosing a super fund, as also mentioned by Moneysmart. But how much of a difference do fees really make?

First, let’s go through the different types of fees you’ll find in a super fund. There most common types of fees and costs are:

- Admin fees and costs – the cost of maintaining the infrastructure of the super fund. The fee can be a fixed $ amount and/or a percentage of your investments.

- Investment fees and costs – the costs of managing an investment option, where the fee gets taken as a percentage of the investment.

- Transaction costs – includes a variety of transaction costs involved within an investment option, where the cost gets taken as a percentage of the investment.

- Insurance fees – the cost of having different types of insurance cover in your super. Learn more about insurance from Moneysmart.

Example of the impact of fees

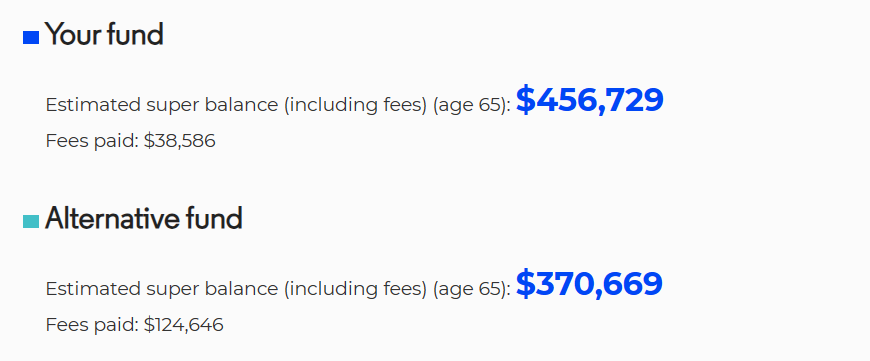

Suppose a 25 year old has an income of $60,000 with a super contribution rate of 12%, a starting balance of $10,000, and they plan to retire at 65 years old. Suppose they have a choice between two super funds where both have an admin fee of $78, but one has an investment fee of 0.20% while the other has an investment fee of 1.20%. Let’s also assume both super funds have the same annualised return of 7.5% per year. Putting all of this into Moneysmart’s Superannuation calculator, we get the following result (adjusted for inflation with additional assumptions listed on the website):

That’s a difference of over $85,000 in the ending super balance! If the alternative super fund had an investment fee of 0.5% instead of 1.2%, the difference in the ending super balance would be almost $30,000. This is still a sizable difference despite the investment being 0.3% more. Keep in mind that these examples do not take into account increases in income or extra super contributions, which would magnify the effects of higher fees.

Although the above example examines what extra fees would do to the ending super balance, the example could also apply to asset allocation (the proportion of equities to bonds). Vanguard calculated the performance of different allocations from 1926 to 2021 (past performance does not indicate future results), where 100% in equities had roughly an extra 1% in returns per year compared to 80% in equities and 20% in bonds. Of course, the investor would be taking on more risk with a 100% equity portfolio, but assuming a hypothetical investor has the risk tolerance for 100% equities, an 80/20 portfolio for this investor would be equivalent to an extra 1% in fees.

We’ve only talked about the effect of fees on your ending super balance, but fees can also affect your retirement. Mahaney (2023) found that on average, a 1% fee during retirement results in a 15% reduction in retiree income and a 23% reduction in inheritance amount.

Conclusion

The effects fees can have on your super can be substantial, from having a smaller ending balance to the reduction in retiree income and inheritance amount. This is why it is important for individuals to be aware of the impact fees can have on their retirement savings and to make informed decisions by looking at the cost of the super fund, which includes the cost of the investment option and insurance premiums. It is also why it is important to consolidate your super funds if you have more than one super fund, to avoid paying more than necessary.