Why index funds are the optimal place to start

Investing for beginners: Part 4 of 8

In the previous article: The academic evidence against stock picking & trading, I showed overwhelming evidence that the average stock picker or trader will underperform the market over the long term. So if we can’t beat the market, wouldn’t the next best thing be to match the market’s performance?

In the 1960s and 1970s, many academics and practitioners supported the idea of having a fund capture the market’s performance. This finally materialised in 1976, when John Bogle founded Vanguard to launch the first mutual index fund to track the performance of the US market. Before diving into index funds, let’s first explore the academic evidence that laid the groundwork for index funds.

We first need to go back to 1952, when Harry Markowitz introduced the idea of Modern Portfolio Theory (MPT). The general concept behind the theory is that for a given level of expected return, investors would like to minimise the variance (or standard deviation) of the portfolio. Likewise, for a given level of variance, investors would like to maximise the expected level of return.

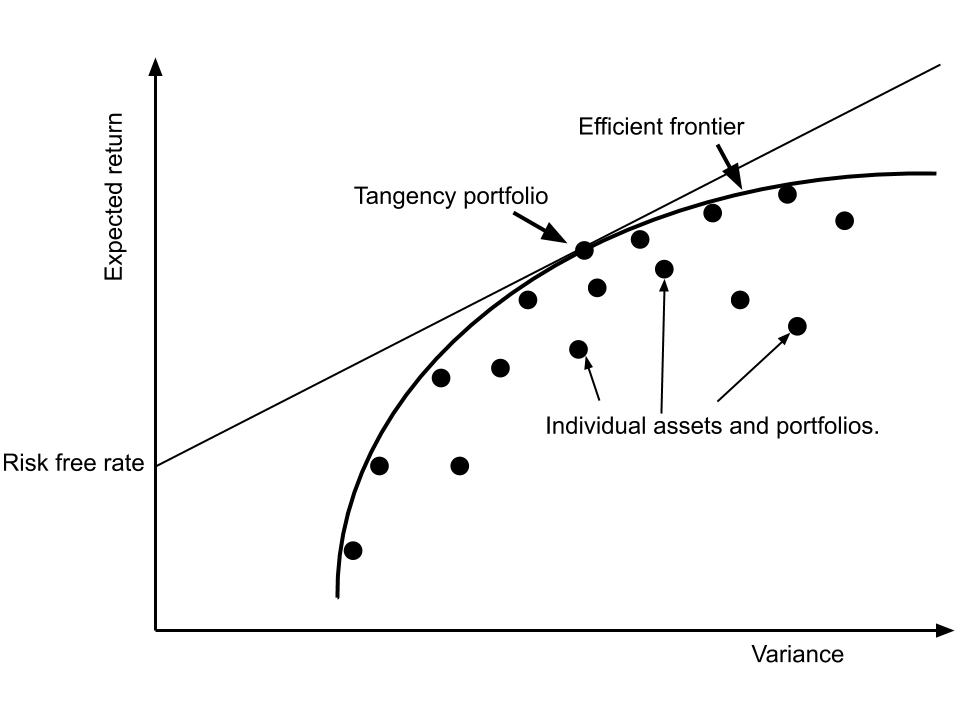

This concept manifests in the image below (image comes from The Wealthy Finn):

- Individual assets and portfolios: these include all investable companies in the world as well as every combination of those companies. This also includes assets other than equities, such as gold and bonds.

- The efficient frontier: is a curve that contains efficient portfolios. What it means to be efficient is that, by taking any point on the curve, going below the curve means having a lower expected return for the same amount of variance, and going to the right of the curve means having the same expected return for more variance.

- Tangency portfolio: an efficient portfolio that has the highest Sharpe ratio, which means having the highest ratio between expected return and variance.

- Risk-free rate: a theoretical asset that has zero risk.

- Capital allocation line: it is the efficient line that intersects the tangency portfolio and the risk-free rate. This line is efficient because if an investor wants a portfolio that is less risky than the tangency portfolio, then the best way to do this would be to take some combination of the tangency portfolio and the risk-free rate. If an investor wants a portfolio that is more risky than the tangency portfolio, then the best way to do this would be to borrow at the risk-free rate to buy more of the tangency portfolio.

Something interesting this model suggests is that it is almost never efficient to have a portfolio of only a handful of individual companies. This is because of idiosyncratic risk.

Idiosyncratic risk (also known as unsystematic risk, specific risk, or diversifiable risk) is a risk that is not compensated with additional returns, and is prevalent when concentrating into companies, sectors, and countries. Idiosyncratic risk differs from systematic risk, which is a compensated risk that affects the overall market, driven by factors such as interest rates, inflation, or geopolitical events.

What makes idiosyncratic risk inefficient is because it can almost be eliminated through the power of diversification, leaving only systematic risk. That is why instead of only holding a handful of companies, holding thousands of companies across sectors and countries will help minimise idiosyncratic risk.

To further expand upon MPT, William Sharpe, Jack Treynor, John Lintner, and Jan Mossin all independently developed the Capital Asset Pricing Model (CAPM). A key takeaway from CAPM is that an asset’s price is determined by how much it contributes to the expected return and risk of the market portfolio. Therefore, assuming an efficient market where assets are priced correctly, the market portfolio is the tangency portfolio. A common proxy for the market portfolio is to use index funds to invest in companies at their market-cap weightings. This involves weighting companies based on how big they are, where the largest company would have the largest weighting in the fund and the smallest company would have the smallest weighting.

In conjunction with CAPM, the Efficient Market Hypothesis (EMH), popularised by Eugene Fama’s 1970 paper, hypothesised that asset prices reflect all available information. There are three categories of efficiency the market could be in, although it is believed that the stock market is likely weak-form efficient. Weak-form efficiency suggests that current stock prices reflect information contained in all past prices, implying that charts and technical analysis that rely on past prices alone would be unable to beat the market over the long term. Therefore, the hypothesis would suggest that no group of investors would be able to consistently beat the market using a common investment strategy and that using index funds would be a better strategy (more info here).

With the three models I’ve listed here, note that these are only approximations of the real world. “All models are wrong, but some are useful“. Specifically for the EMH, markets are not perfectly efficient in the real world. However, even if the market is not perfectly efficient, it should still be treated as such. This is because academic research has shown inefficiencies are difficult to consistently exploit after costs.

Active Managers

The job of active managers is to have their fund outperform the market by beating a benchmark that best represents the universe of stocks they invest in. For example, an active manager trying to outperform the Australian market may use the S&P/ASX 200 as the benchmark, consisting of the top 200 Australian companies. Now, if the average stock picker can’t reliably outperform the market, then surely active managers who have all the time and resources would fair a better chance?

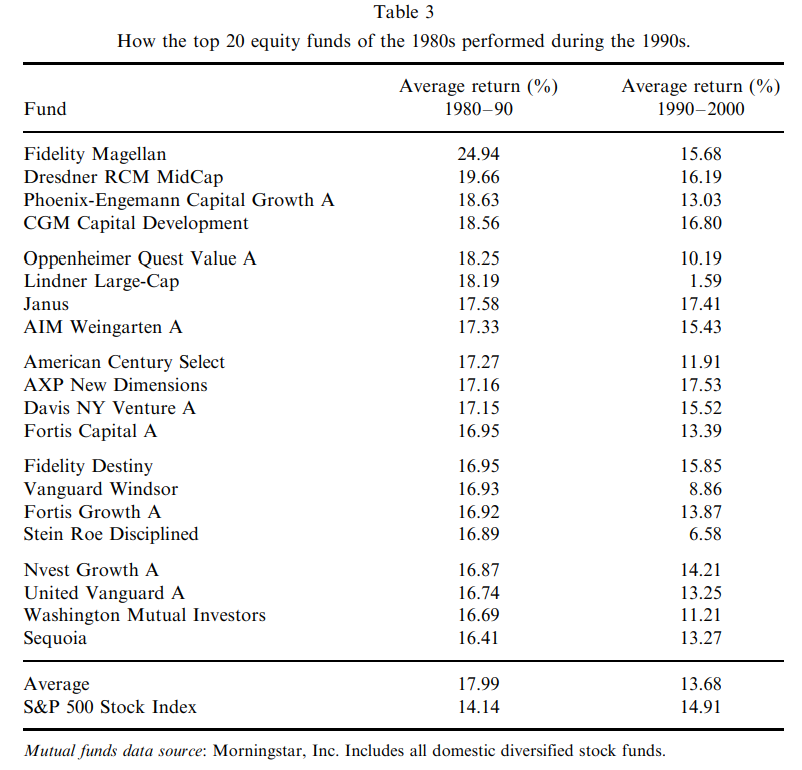

Malkiel (2003) wrote a short paper favouring index funds over active management. They noted that over a 10-year period ending in 2001, 71% of actively managed equity funds underperformed the S&P 500, with the median active manager underperforming the market by more than 1.75%. Although there were some active managers who outperformed, investors cannot rely on a fund’s past performance to determine its future success. Malkiel illustrates this by showing the top 20 funds in the 1980s and then showing how the average return of the funds in the following decade underperformed the market.

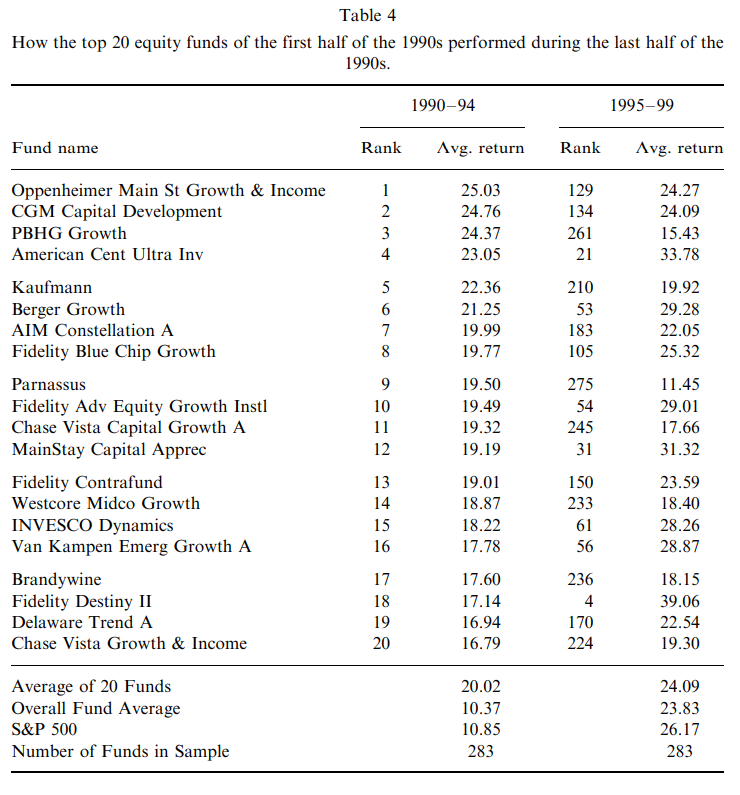

Malkiel does the same thing, except for the top 20 funds from 1990 to 1994, and compares the performance to the following five years.

Other papers that find evidence that most active managers underperform the market, and in turn index funds, are Jensen (1967), Carhart (1997), Fama and French (2010), and Bessembinder, Cooper, and Zhang (2023).

Conclusion

Now, with all this support for index funds, this isn’t to say that everyone should only use index funds. However, as Malkiel writes:

And if you do decide to alter your portfolio from market weightings, you can do so with much less risk if your active bets are made around a core portfolio that is broadly indexed.

At the very least, index funds is a good starting point that can be the entirety of your portfolio or be used as a core to be built around. So how does one choose index funds? I cover this in my next article: Choosing Index Funds for Australians