All-in-one ETFs: Using a single ETF to get global exposure

The objective of these ETFs is to gain exposure to both the Australian market and the global market, all in one ETF. Key differences are summarised in the table below:

| VDHG* | DHHF | IGRO | |

|---|---|---|---|

| Management Expense Ratio (MER) | 0.27% | 0.19% | 0.22% |

| Tax drag | 0.00% | 0.09% | 0.00% |

| Total cost (before tax) | 0.27% | 0.28% | 0.22% |

| Estimated total after tax cost^ | 1.35% | 0.97% | 1.12% |

| Assets Under Management (AUM) | $2.87 billion | $0.62 billion | $0.013 billion |

| Growth/Defensive | 90%/10% | 100%/0% | 90%/10% |

| Australian equity proportion | 40% | 35% | 37% |

| Underlying holdings | Managed funds & ETFs | ETFs | ETFs |

| Hedging | Yes | No | Yes |

| ESG | No | No | Yes |

| Inception date | 20/11/2017 | 15/12/2020 | 17/08/2022 |

*VDAL is now available as a 100% equities Vanguard ETF.

^Taken historical distribution yield from Jan 2025 ASX Report, which was 3.39%, 2.17%, and 2.82%, respectively. Assumed a 32% tax rate.

Additional information

Tax drag

Tax drag commonly occurs when you directly or indirectly hold a US-domicled ETF (an ETF aimed at US citizens) and that ETF holds companies outside the US. PassiveInvestingAustralia goes into more detail in their article. For DHHF, it holds the ETFs SPDW and SPEM, which are US-domiciled ETFs that invest in companies from developed countries and emerging markets.

u/HockeyMonkey_19 calculated the tax drag of DHHF at the end of 2020 and got 0.09% (their calculations can be seen here). I also calculated the tax drag of DHHF from 2010 to 2022 and found the average tax drag to also be 0.09% (calculations found here).

Assets Under Management (AUM)

The AUM of a fund is the total amount of money invested by all its investors. To avoid the risk of a fund closing down due to insufficient assets, a general rule of thumb is for the fund to have at least a $100 million or $0.1 billion AUM. A higher AUM means higher liquidity and thus a lower buy/sell spread, which is how much the buy price and sell price differ from how much the fund should be worth (also known as the Net Asset Value or NAV).

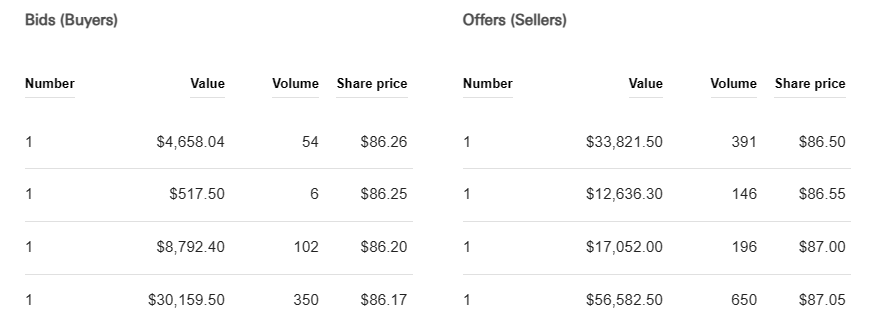

Below is an example of a buy/sell spread:

The NAV for this fund was $86.30 at the time, making the buy spread 0.05% ($86.30/$86.26 – 1) and the sell spread 0.23% ($86.30/$86.50 – 1). This is just an example and does not reflect typical buy/sell spreads.

Growth to defensive allocation

According to Vanguard, from 1926 to 2019, 100% equities had a ~0.30% higher return than 90% equities and 10% bonds. Of course, having 10% bonds does help reduce the risk of the portfolio. Vanguard Australia provides the following reason for including bonds in VDHG:

The allocation to bonds plays a critical role in the asset allocation mix by providing downside protection during periods of equity market volatility. They fulfill the role of the defensive split within a portfolio, providing diversification and a buffer against equity risk during downturns.

Vanguard did recently release VDAL, a 100% equities ETF.

Australian equity proportion

I already wrote an article to help in choosing how much Australian exposure is reasonable: What Australian/International allocations should you choose. Although the 5% difference between VDHG and DHHF means that it won’t matter too much in the grand scheme of things.

For those wondering how I got the allocations for VDHG and IGRO, we need to take bonds out (which is about 10%) to get the Australian equity proportion:

- VDHG: 36% / 90% = 40%

- IGRO: 33% / 90% = 37%

Underlying holdings

Managed funds are more tax inefficient than ETFs, which I covered in this article: ETFs vs managed funds. Although Vanguard has announced that they will be slowly transitioning the underlying holdings of VDHG from managed funds to ETFs, currently the majority of VDHG’s holdings are managed funds.

The ETFs or managed funds the one-in-all ETFs hold are listed below:

VDHG

- Vanguard Australian Shares Index Fund (36%)

- Vanguard International Shares Index Fund (26%)

- Vanguard International Shares Index Fund Hedged (16%)

- Vanguard Global Aggregate Bond Index Fund Hedged (7%)

- Vanguard International Small Cos. Index Fund (6%)

- Vanguard Emerging Markets Shares Index Fund (5%)

- Vanguard Australian Fixed Interest Index Fund (3%)

DHHF

- A200 – Betashares Australia 200 (35%)

- VTI – Vanguard Total Stock Market (39%)

- SPDW – SPDR Portfolio Developed World (20%)

- SPEM – SPDR Portfolio Emerging Market (7%)

IGRO

- IESG – iShares Core MSCI Australia ESG (33%)

- IWLD – iShares Core MSCI World ex Australia ESG (44%)

- IHWL – iShares Core MSCI World ex Australia ESG (AUD Hedged) (13%)

- IGB – iShares Treasury (4%)

- IYLD – iShares Yield Plus (3%)

- AESG – iShares Global Aggregate Bond ESG (AUD Hedged) (3%)

Hedging

By holding assets outside of Australia, you will be subjected to exchange-rate fluctuations, and so the strengthening or weakening of the home currency against foreign currency can have an impact on the performance. It makes sense to hedge international bonds, as exchange-rate fluctuations are more volatile in bonds. For international equities, Vanguard (2015) suggests the following reasons for hedging:

- Have access to low-cost products for achieving hedged exposure.

- Do not believe that foreign currency will diversify their portfolio.

- Have greater exposure to foreign assets (in other words, a smaller allocation to domestic assets).

- Have an explicit portfolio objective of minimising realised global equity volatility.

An important factor to consider with hedged products is whether they implement ToFA (more details about ToFA can be found here). VDHG and IGRO do not implement ToFA on their hedged products, which means that they are significantly tax inefficient compared to unhedged products or hedged products that use ToFA.

ESG

ESG investing aims to overweight companies that have favourable Environmental, Social, and Governance characteristics and underweight companies that show unfavourable characteristics. However, the drawback to ESG is the expected lower return and risk, as detailed in this article. This type of investing deviates from a pure passive portfolio, but can suit those who prefer to overweight towards “greener” companies and does not wish to use more expensive ethical-focused funds. Although, there is evidence by Hartzmark and Shue (2023) that ESG investing may be counterproductive to making “brown” firms more green.