DIY Portfolio: ETFs to invest in the Australian and International markets

Australian exposure: A200 vs IOZ vs VAS vs STW

The objective of these ETFs is to gain exposure to the Australian market by investing in the largest Australian companies through a market-cap weighted index. Key differences are summarised in the table below:

| A200 | IOZ | VAS | STW | |

|---|---|---|---|---|

| Management Expense Ratio (MER) | 0.04% | 0.05% | 0.07% | 0.05% |

| Assets Under Management (AUM) | $3.68 billion | $4.48 billion | $13.18 billion | $4.64 billion |

| Index | Solactive Australia 200 Index | S&P/ASX 200 Index | S&P/ASX 300 Index | S&P/ASX 200 Index |

| Securities lending | No | No | Yes | No |

| Replication strategy | Full replication | Full replication | Full replication | Full replication |

| Inception date | 07/05/2018 | 09/12/2010 | 04/05/2009 | 24/08/2001 |

International exposure: BGBL vs IWLD vs VGS

The objective of these ETFs is to gain exposure to the International market by investing in large and medium cap companies from developed countries through a market-cap weighted index or with an ESG filter. Key differences are summarised in the table below:

| BGBL | IWLD | VGS | |

|---|---|---|---|

| Management Expense Ratio (MER) | 0.08% | 0.09% | 0.18% |

| Assets Under Management (AUM) | $0.39 billion | $0.76 billion | $6.33 billion |

| Index | Solactive GBS Developed Markets ex Australia Large & Mid Cap Index | MSCI World Ex Australia Custom ESG Leaders Index | MSCI World ex-Australia |

| Securities lending | No | Yes | Yes |

| Replication strategy | Representative sampling | Representative sampling | Full replication |

| ESG | No | Yes | No |

| Inception date | 09/08/2023 | 28/04/2016 | 18/11/2014 |

International exposure: VTS/VEU

An alternative to getting exposure to the international market is to use VTS and VEU. Information about these ETFs is summarised below:

| VTS | VEU | |

|---|---|---|

| Management Expense Ratio (MER) | 0.03% | 0.08% |

| Tax drag | 0.00% | 0.29% |

| Total cost | 0.03% | 0.37% |

| Assets Under Management (AUM) | $3.67 billion | $2.71 billion |

| Index | CRSP U.S. Total Market Index | FTSE All-World ex US Index |

| Securities lending | Yes | Yes |

| Replication strategy | Representative sampling | Full replication |

| Inception date | 12/05/2009 | 12/05/2009 |

Since VTS/VEU is roughly equivalent to the MSCI ACWI ex Australia Index, you can determine what proportion VTS should have by looking up the country weight of the US in MSCI’s factsheet. For example, with a VTS proportion of 60%, the total cost of VTS/VEU would be 0.166% (60% x 0.03% + 40% x 0.37%).

The pros and cons of using VTS/VEU vs BGBL, IWLD, or VGS are:

- Domicile: BGBL, IWLD, and VGS are Aus-domiciled ETFs, intended for Australian citizens. Although VTS and VEU are available on the Australian Stock eXchange (ASX), they hold US-domiciled ETFs, which are VTI and VXUS respectively. The consequences of US-domiciled ETFs are US estate tax issues, which involve sending a W-8BEN form every 3 years (a relatively straightforward process), an extra 15% tax penality if you forget to fill out the W-8BEN form, and the possibility of tax law changes negatively impacting you.

- Exposure: VTS/VEU invests in the US (large, mid, and small cap) + International (large and mid cap) + Emerging Markets. On the other hand, BGBL, IWLD, or VGS invest in the US (large and mid cap) + International (large and mid cap). This means that when using BGBL, IWLD, or VGS, you’ll be missing exposures to international small cap and emerging markets. This can be seen as a positive or a negative, as you have the flexibility to choose to include other ETFs to get those exposures at the cost of a little more portfolio complexity. I will not talk about ETFs international small cap and emerging markets in this article, but I will do so in the future.

- Distribution Reinvestment Plan (DRP): DRP is the ability to reinvest distributions back into the ETF automatically. VTS and VEU do not offer DRP as they are US-domiciled ETFs.

- Tax efficiency: US-domiciled ETFs are more tax efficient than Aus-domiciled ETFs because of heartbeat trades, where capital gains do not get distributed to the shareholders. HockeyMonkey estimates that VTS/VEU gets an additional 0.5% after-tax return compared to VGS/VGE (VGE is an ETF for emerging markets).

Additional information

Tax drag

Tax drag commonly occurs when you directly or indirectly hold a US-domicled ETF (an ETF aimed at US citizens) and that ETF holds companies outside the US. PassiveInvestingAustralia goes into more detail in their article. For VEU, its underlying holding is VXUS, which is a US-domiciled ETF that invests in companies from developed countries and emerging markets.

HockeyMonkey calculated the tax drag of VEU for 2019 and got 0.32% (their calculations can be seen here). I also calculated the tax drag of VEU from 2013 to 2022 and found the average tax drag to be 0.29% (calculations found here).

Assets Under Management (AUM)

The AUM of a fund is the total amount of money invested by all its investors. To avoid the risk of a fund closing down due to insufficient assets, a general rule of thumb is for the fund to have at least a $100 million or $0.1 billion AUM. A higher AUM means higher liquidity and thus a lower buy/sell spread, which is how much the buy price and sell price differ from how much the fund should be worth (also known as the Net Asset Value or NAV).

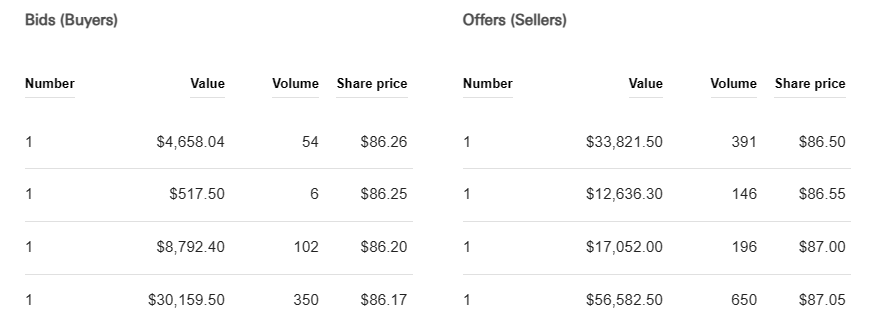

Below is an example of a buy/sell spread:

The NAV for this fund was $86.30 at the time, making the buy spread 0.05% ($86.30/$86.26 – 1) and the sell spread 0.23% ($86.30/$86.50 – 1). This is just an example and does not reflect typical buy/sell spreads.

Securities lending

Securities lending is the process of lending a security, such as an individual stock or bond, to a person or institution who then needs to pay a fee to the lender. In short, securities lending is a way for fund managers to generate extra revenue from their ETFs, adding to the return of the ETF. This could add anywhere from 0.00% to 0.05% to an ETF’s annual return. So for ETFs like VAS, they are actually more competitive than they first appear. If you wish to go more in-depth, u/UnnamedGoatMan wrote this post going through the details of securities lending and how Vanguard Australia conducts their securities lending program.

Replication strategy

There are two main methods of tracking an index: full replication and representative sampling.

- Full replication: owning every stock in the index at its specified proportions. This strategy can be challenging to implement as it can require adjusting thousands of stocks, especially those that are costly to trade.

- Representative sampling: only invests in a sample of the companies in the index while still trying to match the performance of the index. Sampling the index creates the potential to not properly follow the index because of the more active approach. But the strategy hopes to reduce trading costs by reducing the number of companies it needs to hold.

So, how do these strategies compare against each other? Dyer and Guest (2022) sought to answer this question, finding that sampling generally performs worse than full replication both before and after fees. On top of performing worse, sampling also had slightly more volatility. However, the exception the authors found was for indexes that contain a large number of companies. They found that for indexes that contain somewhere between 1000 and 3000 stocks, the performance between sampling and full replication is very similar.

Since the indexes that VGS and BGBL track are around 1,500 companies, the performance should be very similar when only considering their replication strategy. As a side note, the paper also found that sampling does not translate into a lower MER, so BGBL sampling the index does not explain its low MER.

ESG

ESG investing aims to overweight companies that have favourable Environmental, Social, and Governance characteristics and underweight companies that show unfavourable characteristics. However, the drawback to ESG is the expected lower return and risk, as detailed in this article. This type of investing deviates from a pure passive portfolio, but can suit those who prefer to overweight towards “greener” companies and does not wish to use more expensive ethical-focused funds. Although, there is evidence by Hartzmark and Shue (2023) that ESG investing may be counterproductive to making “brown” firms more green.

Turnover: S&P/ASX 200 vs S&P/ASX 300

For fund managers to accurately track the index, they are required to buy and sell companies. The buying and selling of companies can incur capital gains, and these gains are passed on to the ETF holders, requiring them to pay tax on these capital gains with their marginal tax rate. That’s why it is generally more desirable to minimise capital gains.

VAS tracks the S&P/ASX 300, and so an argument could be made that there would be higher turnover compared to tracking the S&P/ASX 200 because of the extra 100 companies. To test this, I compared the distributed capital gains from VAS and IOZ over a 10-year period.

My attempt at calculating this can be found here: https://docs.google.com/spreadsheets/d/1KHk2fCjBPrScbNcZR20xnCjGo6RLIX9M/edit?usp=sharing&ouid=110868098764009992952&rtpof=true&sd=true

Counterintuitively, VAS distributed less capital gains relative to its NAV compared to IOZ, as well as an overall lower annual distribution. Note that IOZ may not reflect the turnover or annual distribution for A200 because of tracking different indexes.

Related article: What Australian/International allocations should you choose?