Choosing index funds for Australians

Investing for beginners: Part 5 of 8

In the previous article: Why index funds are the optimal place to start, I touched on the theory behind investing in a market portfolio and why it is sensible to start off with index funds. But I’ve yet to define what exactly an index fund is and how it matches the performance of a market.

Background

So what is an index fund?

Index fund: a fund that tracks an index as a way to passively invest in a particular market segment.

To break down that definition, let me explain it with my own analogy. Imagine trying to bake a cake.

First, you would need a recipe that lists out all the ingredients and provides instructions on how to use the ingredients to make the cake. This is what an index is. An index lists out all the companies and gives instructions on how to invest in them to achieve the objective of the index. But just like you can’t buy a recipe and expect to get a cake, you can’t buy an index.

Now, you cannot simply follow an index yourself, as it is extremely impractical to try and invest in hundreds or thousands of companies. So instead, we use a fund created by fund management companies to follow the index for us, hence index fund.

ETFs vs Managed funds

There are two types of funds to be aware of: managed funds (also known as mutual funds) and Exchange-Traded Funds (ETFs). I list the differences between the two funds in the following article: ETFs vs Managed funds.

However, I’ll only be talking about ETFs, given their rising popularity over managed funds because of its tax efficiency (Moussawi et al., 2025). From 2016 to 2022, the growth of ETFs has been about 3x faster than managed funds across the US and Europe, with 70% of new fund launches in the US being ETFs in 2022 (Kaczmarski et al., 2023).

Which ETFs to choose?

The last phrase I haven’t explained the meaning of in my definition of an index fund is market segment. Just like there are different types of cakes, there are different types of funds that try to achieve different objectives. Going by the conclusion I made in my last article, the best place to start is to mimic the market portfolio.

How one defines the ‘market portfolio’ is subjective, but it makes the most sense to try to mimic the global market and be as diversified as possible.

There are two ways to construct a market portfolio: using an all-in-one ETF or a DIY portfolio. All-in-one ETFs contain global exposure all in a single ETF, as opposed to a DIY portfolio needing multiple ETFs to achieve the same exposure.

Pros and cons of an all-in-one ETF vs a DIY portfolio are:

- Simplicity and behavioural risk: the main appeal of only using one ETF for the equity portion of the portfolio is the simplicity, which in turn reduces the behavioural risk of tinkering with your portfolio. This aspect can be underappreciated when behavioural mistakes can cost you more than the benefits offered by a DIY portfolio.

- Customisation: a DIY portfolio allows investors to choose their exposures, allocations, and strategies that they feel most comfortable with and that best align with their goals. An all-in-one ETF is more restrictive in this regard, which can be viewed as either a positive or a negative.

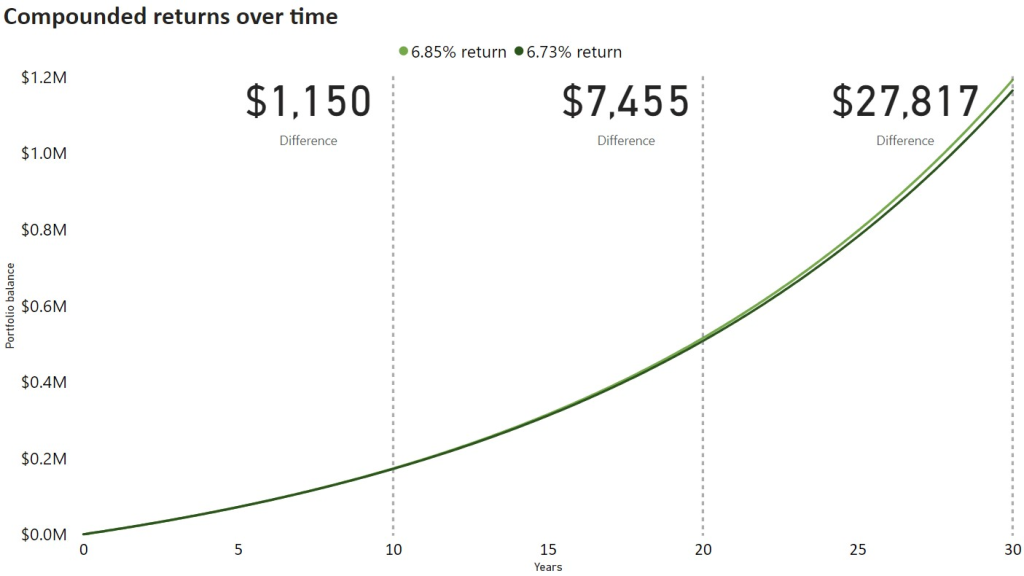

- Cost: a DIY portfolio is cheaper than an all-in-one ETF by about 0.10% to 0.15%. To visualise what kind of impact this makes, let’s assume a return of 7% before fees for two portfolios: a all-in-one ETF with a fee of 0.27% and a DIY portfolio with a fee of 0.15%. With a contribution of $1,000 per month, the following graph shows the performance of the two portfolios:

It is worth mentioning that one can switch between the two types of portfolios. For example, starting off with an all-in-one ETF and switching to a DIY portfolio after becoming more comfortable with investing in the stock market, or switching from a DIY portfolio to an all-in-one ETF for the simplicity.

After deciding on using an all-in-one ETF or a DIY portfolio, the following articles compare different ETFs that can be used as an all-in-one ETF or in a DIY portfolio:

- All-in-one ETFs: Using a single ETF to get global exposure

- DIY Portfolio: ETFs to invest in the Australian and International markets

After deciding on your ETFs, you then choose a broker to buy and sell your ETFs from in my next article: Most popular brokers to buy ETFs